Recorded Live Webinar:

How to make 6-Figure Commissions 2024

DASHBOARD - COURSES - DOCUMENTS

What are Surety Bonds

Surety bonds are an important financial tool that offer assurance and protection to many businesses and individuals. They are commonly used in the United States to guarantee payment of taxes, payment of contractors, and other financial transactions. This lesson will explore the different uses of surety bonds...the common situations in which surety bonds are required, and the advantages surety bonds can provide those who use them.

Surety bonds are a type of financial security that are given to one party (the obligee) by another (the principal) to guarantee that the principal will meet certain financial obligations as agreed upon in a contract. In the case that the principal does not meet their expectations, the obligee can place a claim on the surety bond for the damage or loss incurred. The surety bond is then used to completely or partially fulfill the agreed upon obligations. Surety bonds provide the obligee with a level of protection and assurance that the principal party's obligations will be met. Surety bonds are an increasingly popular way to replace a traditional bond policy or to otherwise guarantee an agreed-upon sum of money.

These instruments can be detrimental in a variety of ways; for instance, they can be costly for the bond issuer and require a complex process that may cause delays in transactions. Surety bonds also can create a situation where the guarantor is responsible for the risk of losses, which in extreme cases may include liability for various damages and legal fees. Furthermore, the law that governs surety bonds is complex and varies from state to state, adding an extra layer of difficulty when dealing with surety bonds. In conclusion, though surety bonds are often necessary for the progress of business, the risks and complexity associated with these financial instruments can be influential.

In conclusion, surety bonds are a great form of risk mitigation used between two parties to protect against contractual obligations and acts of legal wrongdoings. Surety bonds provide financial support and assurance to protect against any risks or losses that may be incurred. While they are not a replacement for a full insurance policy, they can be used to ensure that specific obligations are honored when a contract is in place.

Hazard, Shelley H., et al. Management: A Strategic Approach. 8th ed., McGraw-Hill Education, 2016.

McGovern, Peter. "Surety Bonding: What to Know." Forbes, Forbes Magazine, 2 Mar. 2020, https://www.forbes.com/sites/forbesfinancecouncil/2020/03/02/surety-bonding-what-to-know/#56d87f37401b.

Kelly, Martin. Surety Bond Basics for Your Business. NerdWallet, NerdWallet, 22 May 2020, https://www.nerdwallet.com/article/small-business/surety-bond-basics.

Matthews, Dylan. What Are Surety Bonds & How Do They Work? learnbonds.com, 20 May 2020, https://learnbonds.com/surety-bonds/.

Investopedia. (2017). Surety Bond. Retrieved 24 November 2020, from https://www.investopedia.com/terms/s/surety-bond.asp

Deans, D. (2017). Everything You Need to Know About Surety Bonds. Retrieved 24 November 2020, from https://fitsmallbusiness.com/surety-bonds-everything-you-need-to-know/

Portman, R. (n.d.). Surety Bond Definition. Retrieved 24 November 2020, from https://www.investors.com/glossary/surety-bond/

What others are saying...

Included!

You will Learn How to Monetize Gold and make profit with project funding and trade.

1) how to

Verify Assets

You will learn what due diligence processes are required and which processes should be.

2)

how to

Value Assets

Learn how to get your file on the top of the list and maximize value.

3) how to

Collect an Agreement

You will learn how to create a private agreement regarding private deals, with an individual or business.

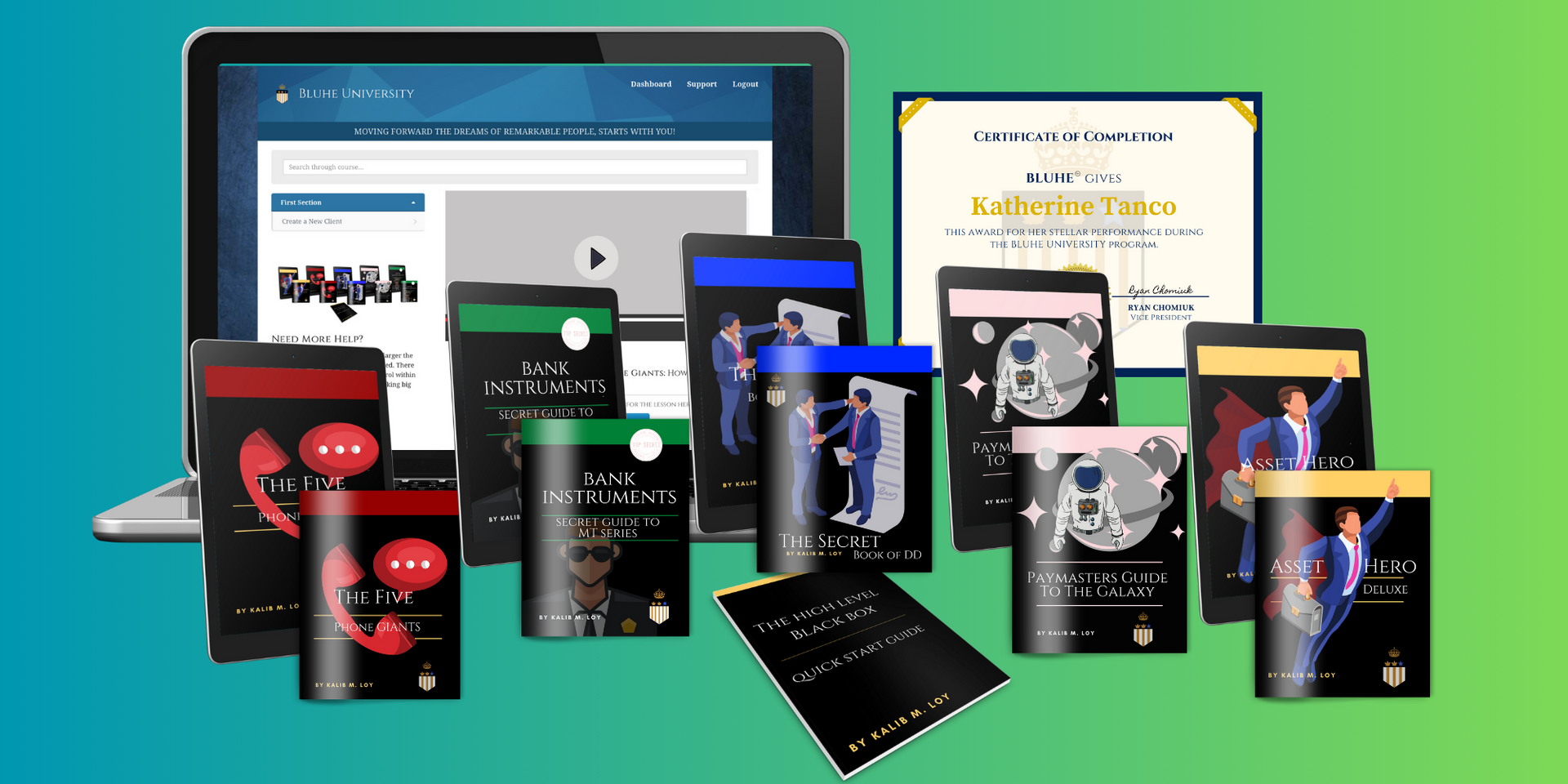

Included!

Asset Classes

structure multiple private files such as:

Asset Hero Deluxe

Learn eight different ways to monetizing assets using the most practical bank instruments available in today's market.

Secret Book

of DD

Learn how to complete due diligence on a new high-level file in five minute or less.

Paymasters Guide to the Galaxy

Learn how to move large amounts of money internationally for project funding of private financial arrangements.

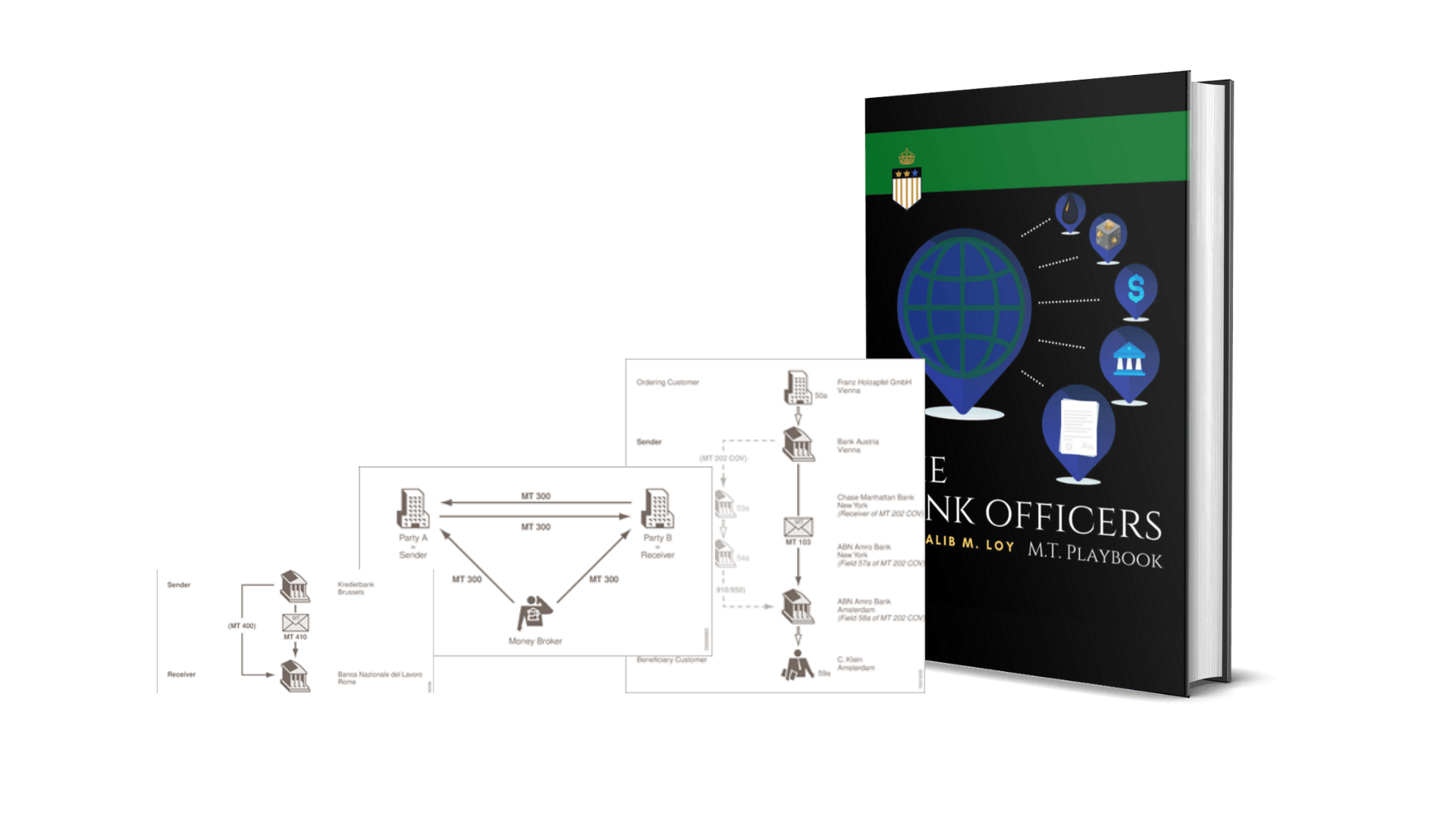

Bank Officers

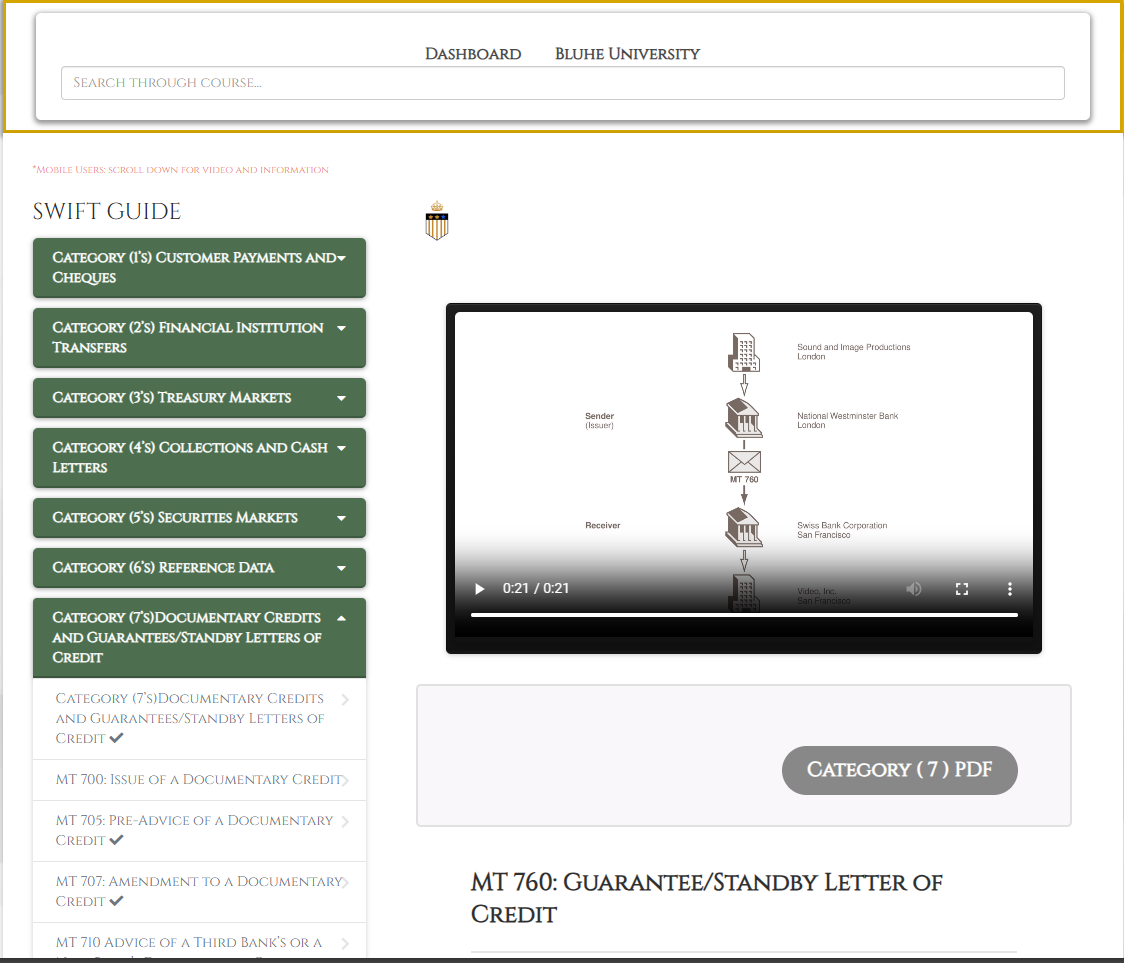

MT Swift Guide

Learn how every SWIFT message can work to your advantage. Including iso2022.

The five

Phone Giants

Learn the five phone practices used by experts to structure and close multi-million-dollar files.

ALL

Included!

Monetizing Instruments 101

Learn How to monetize bank instruments.

ALL

Included!

I.C.C Documents

List of Services

-

I.C.C. Use of SanctionsList Item 1

CONSOLIDATED ICC GUIDANCE ON THE USE OF SANCTIONS CLAUSES IN TRADE FINANCE-RELATED INSTRUMENTS SUBJECT TO ICC RULES

-

I.C.C. Commission on ArbitrationList Item 2

Leveraging Technology

for Fair, Effective and Efficient International Arbitration Proceedings

-

I.C.C. Global Taxation CommissionList Item 3

TAX REFORM FOR REMOTE WORKING ABROAD

-

ICC KYC REG & Maritime

Know your customer and maritime standards.

-

ICC Co-Vid Impact

Over of Co-Vid Impact presented by ICC

-

Anti-Corruption

Anti-corruption for a better and safer future

ALL

Included!

SWIFTLearn PRO