What is a SWIFT GPI transfer?

GPI bank transfer is a Global Payments Innovation standard created for international banking transfers between qualified institutions. The gpi customer credit transfer SLA dramatically improves the business-to-business cross-border payments experience for corporate customers. It commits participating banks to deliver on four core principles. Same day use of funds is increasingly the norm for domestic payments systems and corporates are naturally demanding similar service levels for their cross-border payments.

Fast Resolution Time

On average, 40% of SWIFT gpi payments are credited to end beneficiaries within 5 minutes

Fewer Open Queries

100% of Payments on SWIFT are trackable and no longer require the same wait time caused by chains.

Cost Saving Opportunities

improves operational efficiency, allows for positive relationships with other correspondents

Large Files Accepted

Financial institutions of all shapes and sizes are adopting and using gpi.

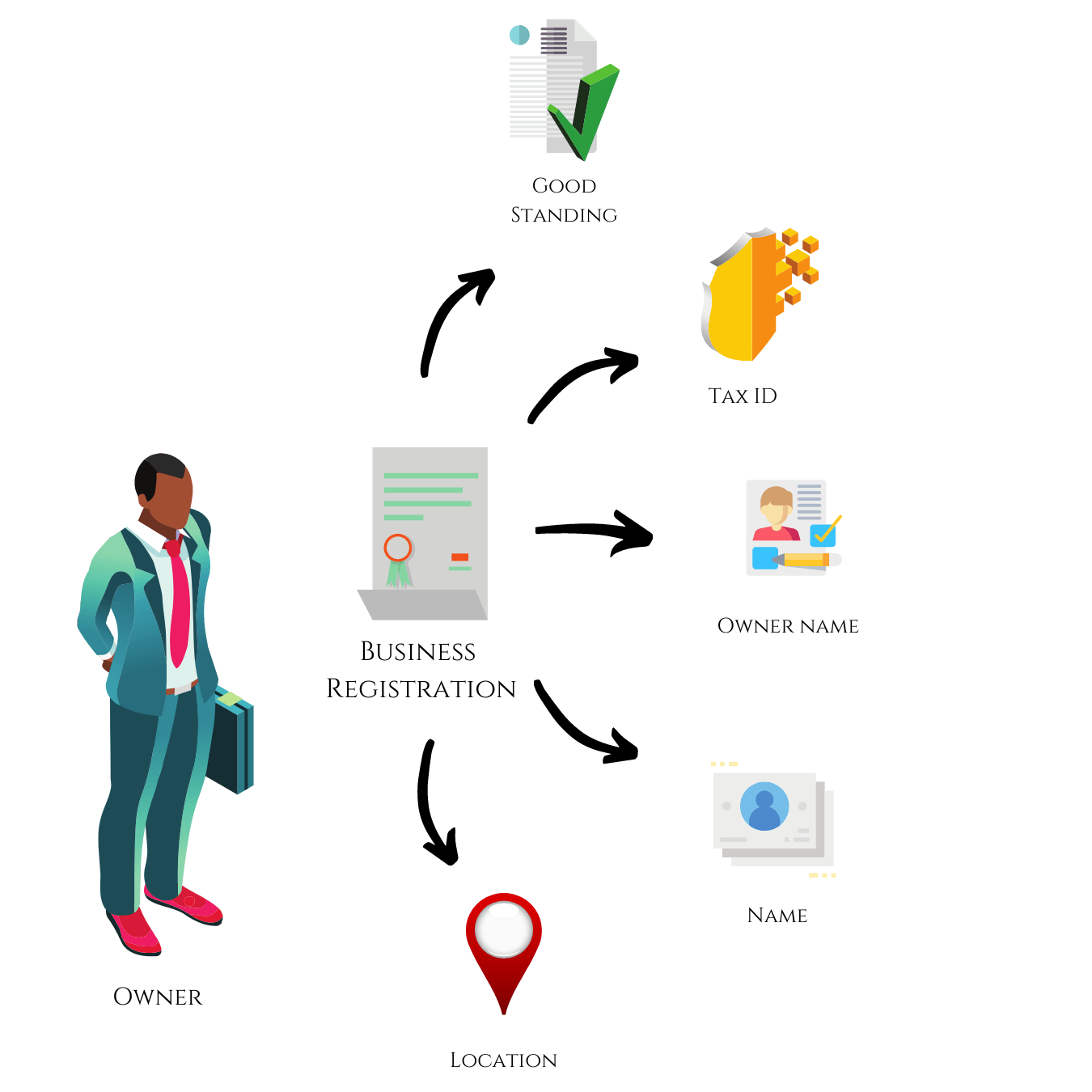

GPI ondoarding Process

What does GPI Look like?

Private bank offering wealth management, deposits and payments services

1) Move to a proactive stance in customer service Move from reactive checks to proactive management of cross-border payments by being notified when a payment is blocked. Reduce your customer lead times on investigations and claims by having real-time status information available to take immediate action.

2) Provide real-time monitoring of business-critical payments Reduce FX, liquidity and settlement risks through faster delivery of funds. Reassure your clients in real-time by tracking the movements of funds and by providing a view on when the beneficiary’s account has been credited.

3)

Boost operational efficiency With gpi you can significantly reduce manual interventions on payment investigations. This allows you to provide better service to your internal and external clients and increase straight-through processing.

Retail bank offering current accounts, loans and other credit products

1) Provide a better customer service Offer a leading customer service experience by providing real time information of payment status and confirmation of credit on the beneficiary’s account. With gpi you can also deliver funds faster (on the same day, often in just minutes or seconds) and with transparency on fees.

2) Optimize straight-through processing With gpi you can drastically decrease manual interventions on payment investigations. This allows you to provide better service to your internal and external clients and increase straight-through processing.

3)

Position your bank as an innovation leader Enhance your offer by displaying information and push notifications to customers on payment status via your mobile apps and digital engagement tools. Leverage SWIFT gpi to provide new features to your customers such as instant payments, visibility on incoming payments or end-to-end procure to pay solutions.

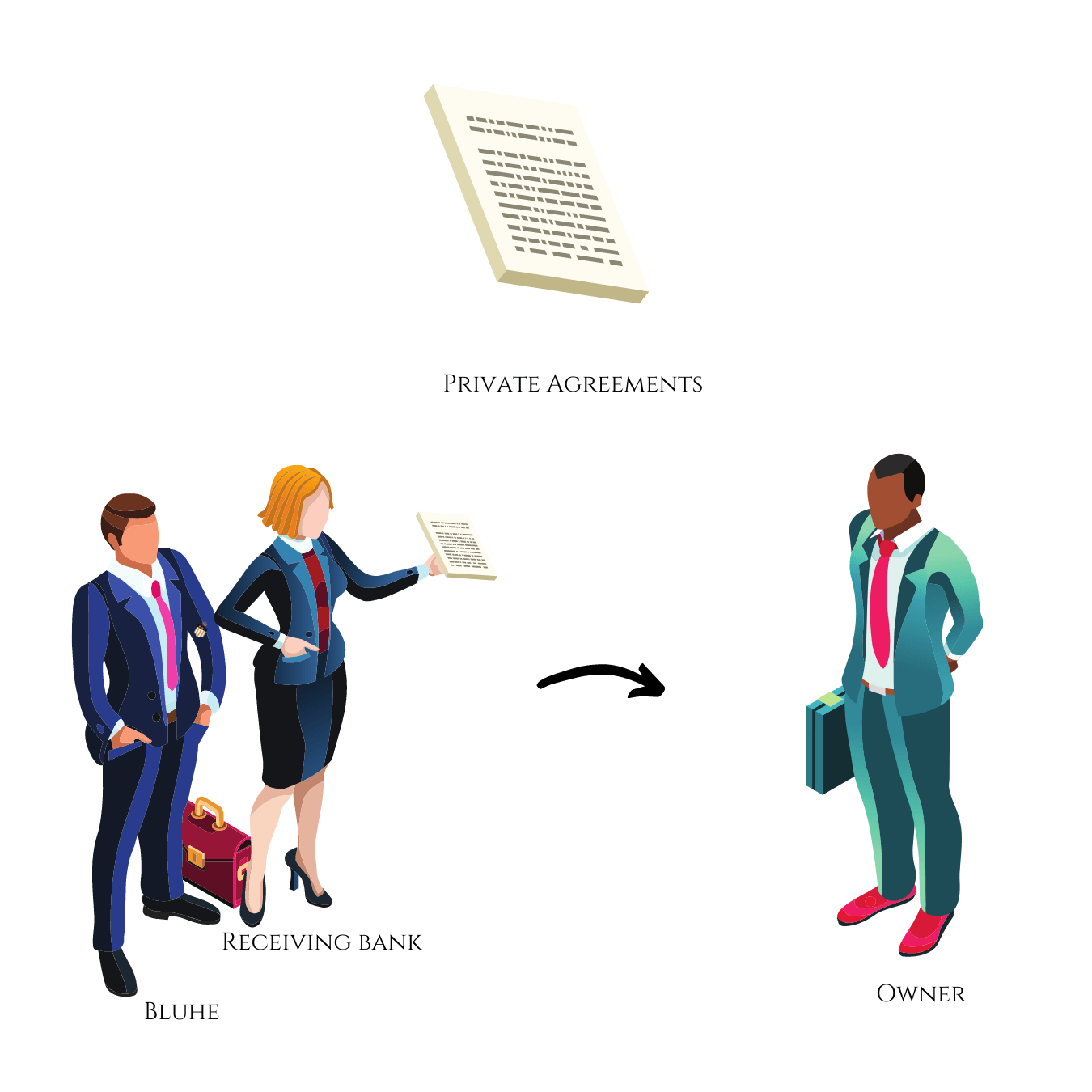

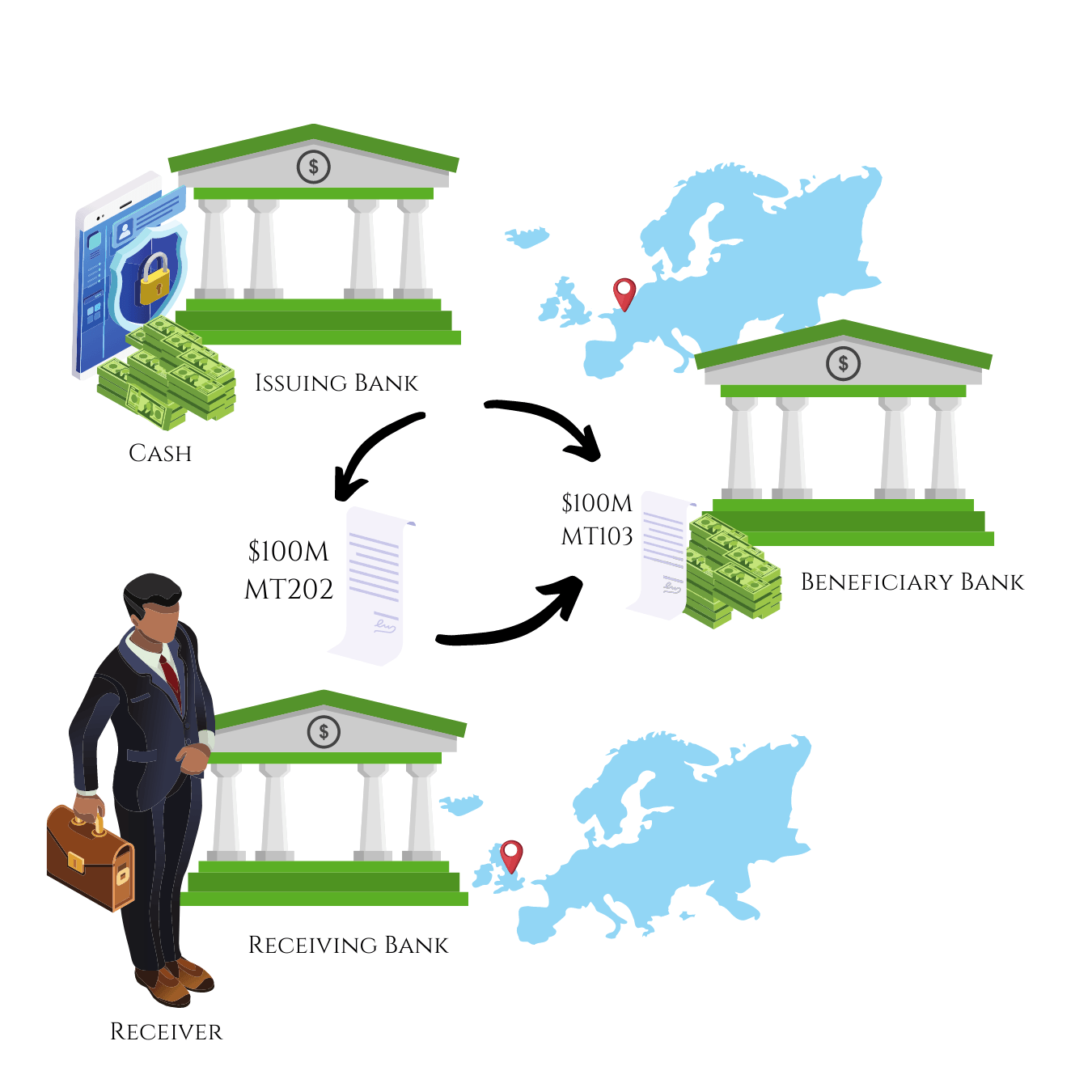

GPI Transfer

SWIFT GPI (Global Payment Innovation) is a service offered by SWIFT that improves the speed, transparency and traceability of cross-border payments. A SWIFT GPI transfer is a cross-border payment processed using the SWIFT GPI system, which uses a unique tracking number, called a UETR, to track the payment and allows for real-time tracking, same-day or faster settlement and the inclusion of remittance information.

What is GPI?

SWIFT GPI (Global Payment Innovation) is a service offered by SWIFT (Society for Worldwide Interbank Financial Telecommunication) that aims to improve the speed, transparency, and traceability of cross-border payments.

A SWIFT GPI transfer is a cross-border payment that is processed using the SWIFT GPI system. The payment is initiated by the sender in their own country and is sent to the SWIFT network, which then routes the payment to the receiving bank in the recipient's country. The SWIFT GPI system uses a unique tracking number, called a UETR (Unique End-to-End Transaction Reference), to track the payment as it moves through the network.

One of the key features of SWIFT GPI is that it allows for real-time tracking of payments, so that both the sender and the recipient can see the status of the payment at any point in the process. Additionally, SWIFT GPI enables same-day or faster settlement of cross-border payments, reducing the time it takes for the funds to be credited to the recipient's account.

Another important feature is that SWIFT GPI enables the sender to include remittance information with the payment, which allows the recipient to easily identify the purpose of the payment and to reconcile it with their own records.

In summary, SWIFT GPI is a service that aims to make cross-border payments faster, more transparent, and more traceable, by enabling real-time tracking and faster settlement, as well as allowing for the inclusion of remittance information.

History OF GPI

SWIFT GPI (Global Payment Innovation) was first introduced in 2017 as a way to address the challenges faced by banks and their corporate customers in cross-border payments. It was developed by SWIFT (Society for Worldwide Interbank Financial Telecommunication) to improve the speed, transparency, and traceability of cross-border payments. In 2018, SWIFT announced that all banks connected to the SWIFT network would be required to implement GPI by the end of 2020. Since its launch, GPI has quickly gained traction among banks and corporations, and as of 2020, more than half of all cross-border payments on the SWIFT network are sent via GPI, making it the new standard for cross-border payments.

How It Works

1. The sender initiates

the transfer

The sender initiates the payment by providing the necessary information, such as the recipient's account number and bank details, as well as the amount of the payment, to their own bank.

2. The sender Sends payment

The sender's bank then sends the payment to the SWIFT network, along with a unique tracking number called a UETR (Unique End-to-End Transaction Reference).

3. The funds are delivered to receiving bank

The SWIFT network routes the payment to the receiving bank, using the information provided by the sender's bank.

4. The recipient receives Funds

The receiving bank then credits the payment to the recipient's account, and the recipient will receive notification of the payment.

Benefits of GPI

Speed

One of the main benefits of SWIFT GPI is that it enables same-day or faster settlement of cross-border payments, which means that the funds will be credited to the recipient's account more quickly.

Real-time tracking

Another key feature of SWIFT GPI is that it allows for real-time tracking of payments, so that both the sender and the recipient can see the status of the payment at any point in the process.

security

SWIFT GPI also improves the security of cross-border payments by using the latest fraud detection and prevention tools and providing a secure, tamper-proof digital trail that can be used for reconciliation and auditing purposes.

transparency

SWIFT GPI also increases transparency by providing detailed information about the payment, such as the fees charged, exchange rates used, and the exact time the payment was settled.